Let’s face it—keeping track of your finances can feel overwhelming, especially with so many tools out there promising to simplify the process. That’s where Quicken Simplified comes in. Designed to cut through the clutter, it offers an easy, no-frills way to manage your budget, track expenses, and stay on top of bills—all without the headache of complex features.

With its latest updates for 2024, Quicken Simplified is more intuitive than ever, making it a great option for anyone looking to take control of their money quickly and effortlessly. But is it the right tool for you?

In this review, we’ll break down everything you need to know: its standout features, how easy it is to use, and the pros and cons of choosing it as your financial sidekick. Whether you’re just starting your budgeting journey or looking for a simpler alternative to your current tool, stick with us—we’ll help you decide if Quicken Simplified fits your needs.

What is Quicken Simplified?

Quicken Simplified is a simpler, easier-to-use version of the popular Quicken software. It’s designed for people who want a no-fuss way to manage their finances—like tracking expenses, setting up a budget, and saving for goals—without getting bogged down by complicated features.

If you don’t need advanced tools like detailed investment tracking or custom reports, Quicken Simplified is perfect for keeping your finances organized and stress-free.

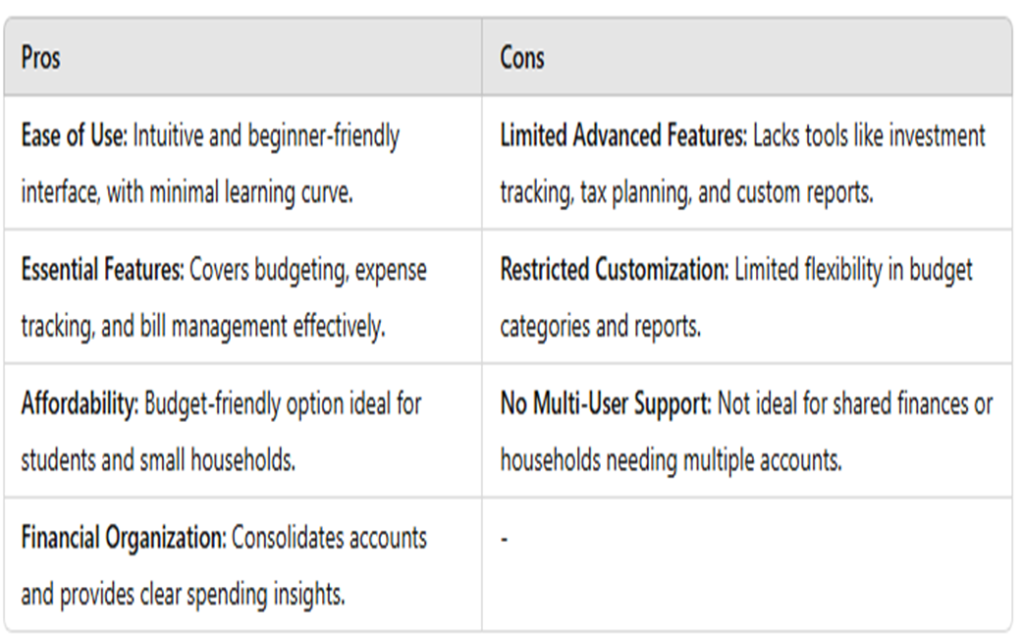

Pros and Cons of Quicken Simplified

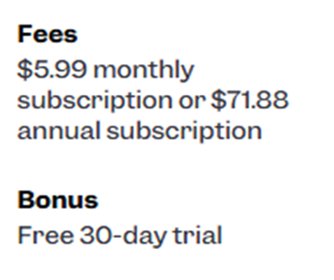

Pricing

Key Features of Quicken Simplified in 2024

Quicken Simplified focuses on what matters—easy, efficient money management. Here are its standout features in 2024:

- Smarter Budgeting and Expense Tracking: Quicken Simplified automates budgeting, tracks expenses effortlessly, and notifies you of overspending, with customizable categories for a personalized experience.

- Hassle-Free Bill Management: Manage all bills in one dashboard, receive payment reminders, schedule payments, and review payment history easily.

- Simple Goal Setting and Savings: Set savings goals, track progress with clear visuals, and get AI-driven tips to save faster.

- Easy Bank Syncing: Sync all your accounts for real-time updates and manage checking, savings, and credit cards in one place.

- Clear Reports and Insights: Access simple spending summaries, and income vs. expense snapshots, and track your net worth for a comprehensive financial overview.

- What’s New in 2024: Upgrades include an improved mobile app with goal-setting features, AI-driven spending insights, and enhanced security with multi-factor authentication and biometric login.

User Experience: How Easy is Quicken Simplified to Use?

Interface and Layout

Quicken Simplified is designed to be user-friendly, with a clean, organized dashboard. You can quickly access budgeting tools, track bills, and see your financial health at a glance. The layout is straightforward, with clear labels and color-coded categories that make it easy to spot spending patterns and monitor progress toward goals. Everything is where you’d expect it to be, so you don’t waste time searching for features.

Learning Curve for Beginners

Setting up Quicken Simplified is simple. A step-by-step guide helps you connect accounts, set budgets, and define goals. There’s no need to be a finance expert—tutorials and in-app tips explain everything in plain language. Automatic syncing with your bank accounts saves you time, making financial management quick and stress-free.

Mobile Accessibility

Quicken Simplified’s mobile app works seamlessly on iOS and Android. It’s just as easy to use as the desktop version, with real-time syncing between devices. You can check your budget, track spending, and stay on top of bills no matter where you are. Alerts and reminders help ensure you never miss a payment or budget milestone.

Who Is Quicken Simplified Best For?

- Beginners and Busy Professionals: If you’re new to budgeting or short on time, Quicken Simplified offers an intuitive interface and straightforward setup process. It helps you take control of your finances quickly and efficiently.

- Individuals with Basic Financial Needs: Whether you want to track your monthly spending, stick to a budget, or build up savings, Quicken Simplified covers the basics without unnecessary complexity.

- Small Households: Perfect for families or couples managing shared expenses, planning savings goals, or keeping tabs on daily spending.

- Mobile Users: Its mobile app is a standout feature, syncing seamlessly with the desktop version, so you can check your budget, track expenses, and monitor savings on the go.

Why You Might Need More Features

Quicken Simplified is an excellent tool for personal budgeting and expense tracking, but it’s not built for everyone. Consider other Quicken products if you have more advanced needs:

- Freelancers or Small Business Owners: You’ll need features like invoicing, tax management, and expense tracking found in Quicken Home & Business.

- Investors: If you manage a complex portfolio, Quicken Premier or Deluxe offers detailed investment tracking and reporting tools.

- Households with Complex Finances: For those juggling multiple accounts, mortgages, and long-term financial planning, Quicken’s full suite provides a higher level of organization and customization.

How to Get Started with Quicken Simplified

Getting started with Quicken Simplified is quick and easy. Here’s what to do:

- Choose a Plan: Head to the Quicken Simplified website, pick the plan that suits your needs and complete your purchase by entering your billing details.

- Set Up Your Quicken ID: If you don’t already have a Quicken ID, simply create one by providing your email address, phone number, and a secure password.

- Link Your Accounts: To get a complete view of your finances, connect your bank accounts, credit cards, and investment accounts. This helps you track everything in one place.

- Input Your Bills and Income: Add details about your regular bills and income so Quicken Simplified can create an accurate Spending Plan and predict your future balances.

- Learn the Basics: Check out the tutorials, videos, and blog posts Quicken Simplified offers to make the most of its features and stay informed about updates.

With just a few steps, you’ll be ready to manage your finances with ease!

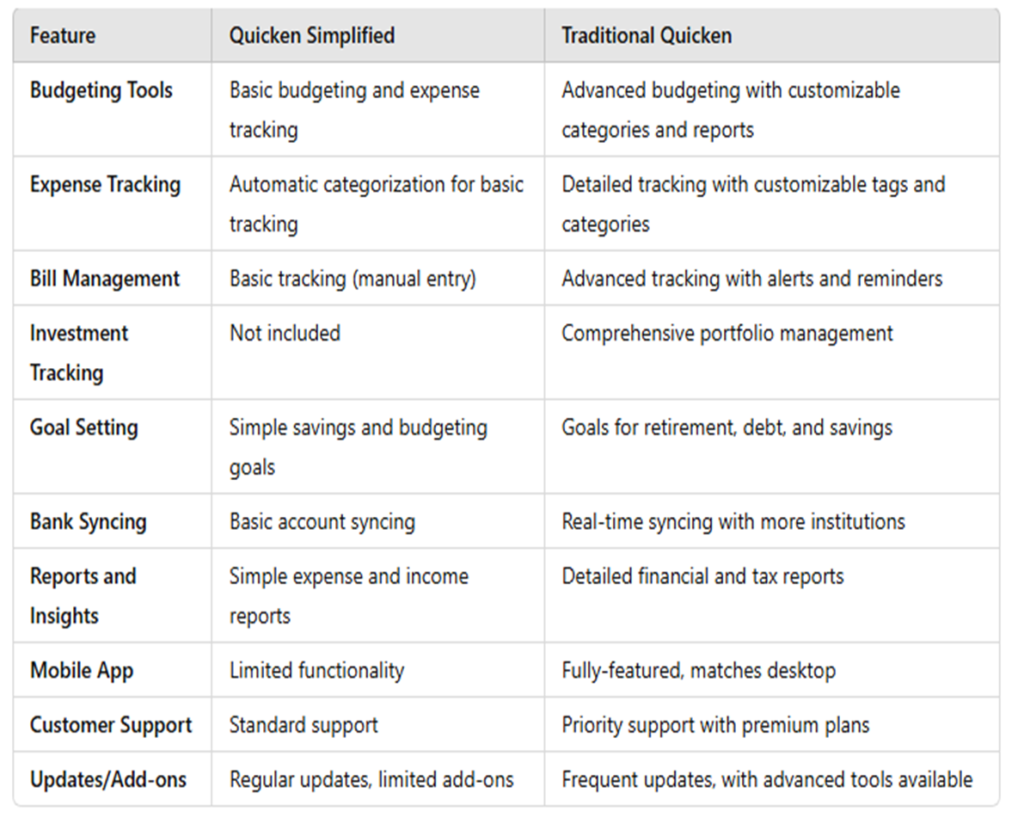

Quicken Simplified vs. Traditional Quicken: Which One is Right for You?

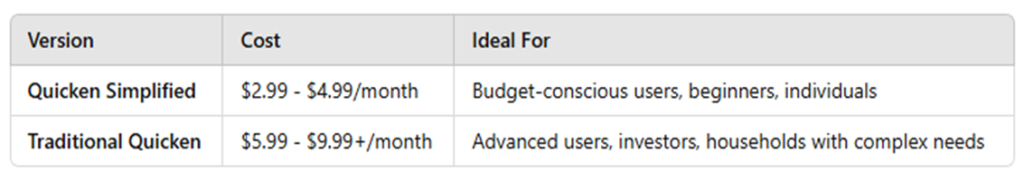

Cost Comparison

Which One Should You Choose?

- Choose Quicken Simplified if you’re new to budgeting, want an affordable tool, or need basic features for managing personal finances.

- Choose Traditional Quicken if you manage investments, property, or complex budgets and need advanced customization and reporting.

Frequently Asked Questions (FAQs)

- What is Quicken Simplified, and how is it different from regular Quicken?

Quicken Simplified is a simpler version of Quicken, focusing on essentials like budgeting and expense tracking. Unlike the full Quicken suite, it doesn’t include advanced features like investment tracking or detailed financial planning, making it ideal for users seeking basic tools.

- Who is Quicken Simplified ideal for?

It’s perfect for beginners, individuals, small households, and busy professionals who want an easy-to-use tool for managing finances without diving into complex details.

- Does Quicken Simplified have a mobile app?

Yes, the mobile app is available for iOS and Android, syncing with the desktop version. It allows users to track expenses, budgets, and account balances on the go.

- What accounts can I link to Quicken Simplified?

You can connect checking and savings accounts, credit cards, and some investment accounts. It supports most major U.S. banks but may not handle complex investment portfolios.

- How much does Quicken Simplified cost in 2024?

Pricing starts around $3–$5 per month, with free trials and occasional discounts for new users.

- What customer support options are available?

Support is offered through email, live chat, and an online help center with tutorials, guides, and forums. Phone support is available for higher-tier plans.

- Can I track investments with Quicken Simplified?

Basic investment tracking is supported, but for detailed tools like analysis and real-time updates, you’ll need more advanced plans like Quicken Premier.

- How secure is my data?

Quicken Simplified uses encryption and multi-factor authentication to protect your financial information. Strong passwords and two-factor authentication are recommended.

- Is Quicken Simplified compatible with Mac and Windows?

Yes, it works on both platforms, with seamless syncing for users switching between devices.

- Can I upgrade to a more advanced Quicken plan?

Yes, you can easily switch to plans like Quicken Deluxe or Premier if you need more features in the future.

- How often does Quicken Simplified get updates?

Updates are rolled out annually with regular improvements throughout the year for performance and new features.

- Is there a free trial?

Yes, Quicken offers a 30-day free trial so you can explore the features before subscribing.

Conclusion

In summary, Quicken Simplified offers an easy-to-use platform for basic budgeting, expense tracking, and goal setting, making it ideal for individuals seeking a straightforward financial management tool without complex features. Its affordability, intuitive design, and essential functionality cater especially to beginners, busy professionals, and small households who want a hassle-free way to monitor finances.

Quicken Simplified is best suited for users who need core financial tracking without the advanced tools found in traditional Quicken or other complex software. If your financial management needs are more extensive—like managing investments or detailed reporting—you may benefit from a more comprehensive tool.

If Quicken Simplified sounds like a fit for your needs, explore further to see how it can streamline your finances. Leave a comment below to share your thoughts or ask any questions—we’d love to hear from you!